Bone Shibaswap (BONE) is an interesting prospect in the field of crypto investments. It plays a vital role within the ShibaSwap ecosystem, and with the forthcoming launch of Shibarium, its potential for growth is notable. Combined with the promising future price projections, BONE stands out as a potential addition to an investor’s portfolio. Analyses from prediction platforms suggest a positive price trajectory for BONE, implying it could yield significant long-term returns. However, the crypto market’s volatility means that investing in BONE involves considerable risk. Therefore, potential investors should conduct thorough research and consider their financial circumstances before investing.

Step 2: Make a deposit or buy Bone ShibaSwap with a credit or debit card

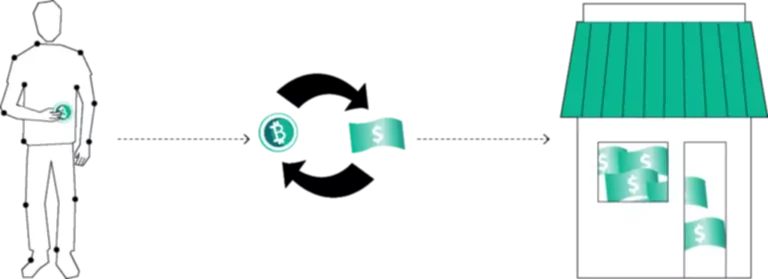

Inside this view you will need to enter the following information to add Shibairum. This will open the spot trade page, enter in the search box BONE/Coin which you have bought or deposited. After clicking on it you will need to select the currency you want to pay with. Buying Bone ShibaSwap (BONE) through an exchange or a broker is fast and easy for beginners. When choosing a centralized exchange, make sure that it supports Bone ShibaSwap (BONE).

How to buy Bone ShibaSwap with a credit or debit card in 5 easy steps?

Once you do, Coinbase will automatically close the ai and machine learning solutions asset selection box and take you back to the original screen to select the number of SHIB tokens you wish to buy. For simplicity purposes, we will focus on the Shiba Inu token in this step-by-step guide, however, the same process could apply to the other two in some instances. Shiba Inu may have started out as an experiment with the hope to replace DOGE, but the community behind the asset has been working to give the token some real-world utility. Please log in to your account or sign up in order to add this asset to your watchlist. Keep reading StealthEX’s article to learn more about the project itself and BONE crypto. Here you will see the estimated amount of BONE coin that you will receive after the exchange.

A Real Shot at Locking In 10,000% Stock Market Gains

Confirm that your selected exchange has solid security, liquidity, and a competitive fee structure. The more Bone you own out of the 250 million total supply, the more voting power you possess. As such, investors are seeking out where to buy their own, so they can start accruing governance power.

More places to buy Bone ShibaSwap

The released Shiboshi sets can be upgraded through power-ups and you can even rename your Shiboshis from the default name for a certain amount. Keep reading StealthEX’s article to learn more about ShibaSwap project itself and BONE coin. Here you will see the estimated amount of BONE crypto that you will receive after the exchange.

Coinomi

On Kraken you can buy, sell and trade $SHIB, you can stake other coins and tokens. You can also trade on margin, spot, and futures for several digital assets. BONE can be purchased on major cryptocurrency exchanges, decentralized platforms, and directly through supported wallets like Walletverse and Trust Wallet. Coinomi is a multi-chain wallet that supports a vast range of cryptocurrencies, including BONE.

With just a couple of clicks, you can make trades directly from your deposit method without even having to wait for funds to clear your account. This one-step ordering is another innovation from a company that prides itself on the usability of its platform. As a utility token, BONE is earned by users who provide liquidity and stake tokens within the ShibaSwap ecosystem. You can also transfer cryptocurrency between exchanges, which can be beneficial if you are looking for additional features or a more competitive fee structure. The process of transferring crypto between Binance and Kucoin, or any other combination of exchanges is very straightforward.

The Shiba Inu team has been working on this project since early what are cryptoassets 2021, highlighting Shiba Inu’s ambitions to become more than just a meme altcoin. ShibaSwap is designed to be as easy to use as possible, while still offering a wide range of features that would satisfy even the most demanding traders. Just like PancakeSwap and Uniswap, ShibaSwap operates without a single or central authority.

- Having once accounted for half of the world’s digital asset transactions, HTX now serves more than 5 million users in over 130 countries around the globe.

- Holding your funds on an exchange provides the most convenient access to investment products and features, such as spot and futures trading, staking, lending, and much more.

- Peer-to-peer (P2P) exchanges connect buyers and sellers directly, allowing you to buy or sell crypto using various payment methods.

- One way or another, BONE has sharply exceeded its historical price highs by 2 times.

- Exodus is a highly intuitive wallet that offers support for BONE along with other cryptocurrencies.

- Our platform does not support this specific payment method for the acquisition of BONE or any other cryptocurrency.

UniSwap

Nowadays, most people prefer to use hardware cold wallets, if you want to store a large number of coins or tokens, you can choose to use a hardware cold wallet to store your assets. Storing your Bone ShibaSwap (BONE) tokens securely is crucial to safeguarding your investment. Since BONE is an ERC-20 token built on the Ethereum network, you will need a cryptocurrency wallet that is compatible with these types of tokens. BONE is mainly used within the ShibaSwap ecosystem for staking and governance. Its usage as a payment method is currently limited due to its niche status within the wider crypto marketplace. However, as the platform and community develop, there may be more applications for BONE in the future.

- SHIB, LEASH, and BONE come together to create the next evolution in DeFi platforms.

- The more Bone you own out of the 250 million total supply, the more voting power you possess.

- Once your account is set up and funded, you can begin purchasing BONE.

- PricePrediction promises the coin steady growth, establishing the maximum price level of BONE crypto at $28.87 in 2031.

- Just a couple of dollars are enough to buy Bone ShibaSwap, with the exact dollar amount depending on the cryptocurrency exchange you want to use.

- After creating an account and completing any necessary identity verification steps, add your bank account details to your account.

With the increasing use of Shibarium, BONE is expected to play an even greater role in blockchain transactions and governance. Beyond the ease of use and innovative features within the trading platform, what stands out about Uphold is the credibility it has gained in the industry. Bone ShibaSwap (BONE -2.11%) is the governance token of the ShibaSwap decentralized exchange, which is part of the Shiba Inu ecosystem. CoinCodex tracks 42,000+ cryptocurrencies on 400+ exchanges, offering live prices, price predictions, and financial tools for crypto, stocks, and forex traders. Just a couple of dollars are enough to buy Bone ShibaSwap, with the exact dollar amount depending on the cryptocurrency exchange you want to use. However, the smaller the amount invested, the smaller the potential upside – and by extension, the lower the risk.

It was established in 2013 and unlike Coinbase, which has reported a minor security incidence, Kraken has not suffered any. To check Bone ShibaSwap’s price live in the fiat currency of your choice, you can use Crypto.com’s converter feature in the top-right corner of this page. Deposit crypto to our exchange and trade with deep liquidity and low fees. Sign up for an account in minutes to buy crypto using credit card or bank transfer.

One of the most encompassing crypto platforms on the market is ShibaSwap. SHIB, LEASH, and BONE come together to create the next evolution in DeFi platforms. ShibaSwap gives users the ability to DIG (provide liquidity), BURY (stake), and SWAP tokens to gain WOOF Returns through our sophisticated and innovative passive income reward system. ShibaSwap also allows the ShibArmy to access upcoming how to create your own crypto coin NFTs and additional tools, such as portfolio trackers, to make navigating the crypto world simple and intuitive.

Trust Wallet is a mobile-based cryptocurrency wallet that offers support for BONE and thousands of other digital assets. As a non-custodial wallet, it gives users full control over their funds. Trust Wallet also provides a built-in Web3 browser, allowing users to connect directly to decentralized exchanges and dApps. Binance is the leading crypto trading platform by daily trading volume, supported coins/tokens, coverage, and products/features. Whatever blockchain-related product or service that you need, Binance probably has it. Everything from staking, trading, brokerage, custody, lending, early-stage investment (or initial exchange offerings), charity, Visa card, e-commerce solution, among several others.

According to the DigitalCoinPrice forecast, the price of BONE could reach $4.29 by 2025. This upward trend continues with a projected price of $5.61 by 2027 and a considerable rise to $13.32 by 2030. These figures suggest a steady increase in the value of BONE over the next decade. Begin by navigating to the Guardarian website at The platform’s intuitive design makes it easy to navigate, even for complete crypto beginners.